About Free Zones:

The UAE today has over 50 free zones with some offering generic activities for all industries, whereas others are industry-specific.The Free Zone Authority handles registration formalities and issues business licenses to non-resident companies or foreign-owned businesses for company formation in free zones.

Free zones have been set up in the emirates in order to attract foreign investment and boost the economy by offering lucrative incentives to foreign entrepreneurs. A business setup in Free Zone offers endless opportunities for networking, collaboration, and substantial growth in the business. Dubai is the nation most preferred by investors for company formation due to its tax regime and numerous incentives offered by the free zone authorities.

With state-of-the-art infrastructure, duty exemptions, and top-notch amenities, free zones are the most ideal locations for setting up businesses

Other Advantages:

- 100% ownership to investors, regardless of nationality

- 100% Corporate tax exemption for 15 years subject to certain conditions

- 100% repatriation of capital and profits

- Import and Export duty exemptions

- Complete secrecy of operations

- No paid-up share capital required

- Physical office space not mandatory

- Option to incorporate remotely

- Flexibility to incorporate in jurisdictions where employee health insurance is not mandatory

- Easy liquidation process

Free Zone Locations in the UAE

Sharjah Media City

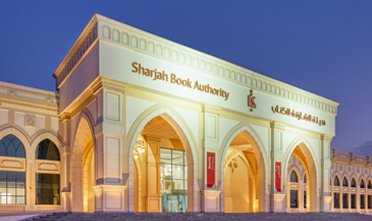

Sharjah Publishing City

International Free Zone

Ras Al Khaimah Economic Zone

Jebel Ali Free Zone

Jebel Ali Free Zone

Dubai World Trade Centre

Sharjah International Airport

Ajman Media City

Dubai Multi Commodities Centre

Meydan

Process for free zone license

- Choose business activity

- Finalize company name

- Complete incorporation paperwork

- License issuance

- Open company bank account

- Receive immigration card

- Process residence visa